Lots of energy saving devices require big investments in upfront equipment. Solar Water Heaters, LED lights, Photovoltaics and Heat Pumps all require big expenditure to get going. They make up for that expense by saving you money in the long term. But how do you decide whether it is best to put your money into your solar water heater, or instead into a savings account? How do you deal with the fact that electricity prices are increasing EVERY year? This article will show you how!

Let’s say you want to buy a solar water heater system. It costs R25000 fully installed and will last for 10 years without needing any maintenance or repairs and will save you 10kWh every day (on average over the year) and you pay R1.50 for every kWh – so every month you expect it to save you R450. (These kind of numbers are subject to change and depend on you and your system, but let’s use it as an example!).

Lots of people think of these kind of investments using methodologies such as ‘pay-back periods’. Here you just take the the amount you spend (R25000) and divide by the savings (R450/month) – so that’s 55 months or 4.6 years until you get paid back. This is nice and simple and will help you to compare savings. However it has 2 big problems:

1. The savings get bigger over time – i.e. electricity prices are going up, so the savings will also go up!

2. It matters how long those savings last – if the system you’re buying lasts 20 years rather than 10 years, the payback period is the same, but clearly the 20 year system is better value for money!

Fortunately there is a better way – we can calculate the ‘return on investment’. We consider all the savings over time and all the expenses upfront and over time and boil that all down into an interest rate.

Basically we take the investment that you’re about to make and compare it to getting interest on a bank account. A 5% return on investment is the equivalent of getting 5% interest on your savings. The timing of the cash flows may be very different — with the savings account you always have access to your money and are not putting your ‘capital’ at risk – so if you put in 20,000 there will always be 20,000 or more available, whereas with an energy efficiency investment, you’re spending money in order to make savings over a long period of time, so that first expenditure is gone from the moment you install it, you’re then waiting for the money to come back to you in savings.

We’ve seen lots of sales people get the numbers completely wrong when they try to work this out. Often, strangely [ 🙂 ] they over-emphasise the return you get from the system, forgetting that at some point the system will need to be fixed/replaced — it has a lifetime — whereas other investments (like savings accounts) you get to choose the lifetime and take your winnings/losses as you go. The key thing to remember, is that if a product lifetime is about the same as the payback period, the interest rate is 0%. The system is ‘paying you back’ for the investment in that time, it’s not making you any gains. If the system will last less than the payback period, then it is losing you money. Only if it lasts longer than the payback period it is a profitable investment, and even then, it’s got all that time to catch-up on.

At Homebug we like to make sure people are doing things right, so we’ve come up with this handy little model to calculate return on investment for any kind of system. We’ve built it quickly into an excel spreadsheet. You can download it here. We’ll work on bringing one in google docs shortly!

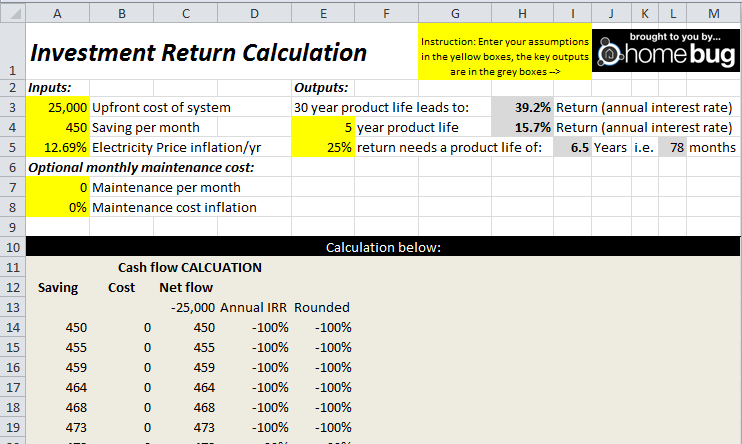

It’s pretty simple to use, just enter the details of your investment in the yellow boxes and the outputs come out in the grey boxes in the right.

For our example solar system, you spend 25,000 on the system and it saves you 450 every month. Also, you can put in how much electricity prices rise every year – 12.69% is the default, as that is the increase happening this year. Finally, you can also add in a monthly ‘service and maintenance’ charge if you’d like. For example, if the system needs a service every year and that costs R600, then add in R50 to the box in cell A7. Also this will increase every year, so add in an inflation number in there too (maybe 5-10%?)

The boxes in the top right then show you the return on investment. The top one shows you the return on investment if the system lasts for 30 years (practically speaking, if it lasts forever!). The next row shows you the return if the system only lasts for 5 years — you can change the 5 years to any number you want — e.g. 8 years, 10 years etc. Finally, you can also enter the return you want (as shown, 25%) and it will tell you how long the system will need to pay to get that return – in this case 6.5 years.

Give us a shout if you think there’s anything wrong, and/or if you want some more added features.

Leave a Reply